Making an attempt to determine whether or not to refinance a mortgage? In our information, we stroll you thru refinance a mortgage and the place to seek out the most effective charges.

Have you ever been in your present house mortgage for a couple of years? Do you see marketed mortgage charges effectively under what you’re locked in for? And do marvel should you may lower your expenses by refinancing?

Should you’ve thought of a refi in your present house mortgage, there are some things to contemplate. Whereas the method itself isn’t tough, it’s a bit concerned. You’ll wish to store round, and it’s best to undoubtedly ask your self some questions first.

We’d prefer to easy the method and provide help to determine your subsequent mortgage transfer. Right here’s every part it’s worthwhile to know if you’re fascinated by refinancing your private home.

Test LendingTree for the checklist of mortgage charges from most well-liked suppliers

In This Article:

- When Ought to You Refinance?

- Mortgage Refinance Calculator

- Will You Save Cash?

When Ought to You Refinance?

There are a couple of key cases in which you’d in all probability contemplate refinancing your mortgage. Let’s discuss a few of them.

Curiosity Charges Have Dropped

Following the housing crash in 2007-08, mortgage rates of interest started to plummet. They reached an all-time report low of three.31 % on November 22, 2012 earlier than trending again upward. Then, in June 2016, they dipped once more, reaching as little as 3.56 %.

Final month (August 2017), the common mortgage rate of interest was 3.88 %. Let’s say you got your private home eleven years in the past, in July 2006, when the common rate of interest was 6.76 %. That’s a distinction of two.88 %, and it’s best to undoubtedly look into refinancing your fee. You’ll definitely save your self a fairly penny in the long run.

However what should you suppose you can get a fee at present that’s solely higher by a % or two? Is that definitely worth the time, effort, and cash concerned with a refi?

Nicely, even 1-2 % could make for some severe financial savings on a mortgage. Simply take a look at this comparability:

As you’ll be able to see, a 30-year mortgage for a $200,000 house (with a $20,000 down cost) will value you $177,840 in curiosity alone in case your fee is 5.25 %. Nevertheless, should you had been to decrease that to 4.25 %, you’d solely pay $138,600 in curiosity (a financial savings of $39,240). And should you snagged a 3.25 % fee, you’d solely pay $101,880 (which suggests $75,960 saved).

That “solely a %” or two really goes a great distance.

We are going to discuss calculate the precise financial savings in only a bit. However for now, know that if rates of interest have dropped, refinancing your private home is a minimum of value contemplating.

Your Credit score Rating Has Improved

As you might be certainly already conscious, your credit score performs a task in figuring out the mortgage loans and charges for which you qualify. So, in case your credit score has modified for the higher, a refi is value contemplating.

Whenever you first took out your authentic house mortgage, your credit score historical past on the time was a major deciding issue. Your lender used it to approve your mortgage and determine which rate of interest they needed to give you.

Within the years which have handed, have you ever paid off money owed? Elevated card limits? Have unfavourable experiences been eliminated out of your credit score? If that’s the case, your credit score has seemingly improved and, in flip, you’re in all probability eligible for a greater fee than you had been once you first obtained your mortgage.

You Need to Decrease Your Month-to-month Fee

One cause that some people refinance their mortgage is to decrease their month-to-month funds. This isn’t all the time the wisest choice, because it sometimes requires extending the mortgage size. Nevertheless, in some circumstances, it’s essential.

For instance, let’s say that you simply’ve been in your house for ten years (with an authentic 30-year mortgage) and lately decided that your cost is simply too excessive. You’ve been slowly paying the debt down over the previous decade, however the month-to-month invoice has begun putting a pressure in your funds. You’d prefer it lowered, however what are you able to do?

Nicely, you’ll be able to refinance the now-reduced steadiness, with 20 years left, into a brand new 30-year mortgage. It will unfold the remaining steadiness out over an extended time frame, reducing your month-to-month funds.

You can also make this a better choice by additionally working to safe a lowered rate of interest. Nevertheless, try to be conscious that, over time, you’re seemingly going to pay extra by going this specific refinance route. As talked about, although, it’s typically a necessity, and is one thing to contemplate in case your month-to-month funds have turn into unmanageable.

You Want Money

Some debtors will contemplate a mortgage refi in the event that they wish to get money out of their house’s fairness. This technique known as a cash-out refinance, and it’s totally different than a HELOC, or house fairness line of credit score.

With a cash-out refinance, you’ll be refinancing the house for greater than you at present owe, with the intention to pocket the money for another use. This can be a route you would possibly contemplate should you want cash for a house rework or the like.

Let’s say that you simply stay in a house value $300,000, however you solely owe $200,000 in your mortgage. (On this case, you might have $100,000 value of fairness constructed up within the house.) You want $60,000 to construct an addition onto the again of the home, and determine that utilizing your private home’s fairness is a good suggestion.

You might have two choices: cash-out refinance or HELOC. With the cash-out refinance, you’ll take out a brand new mortgage value $265,000, then use $200,000 of that to repay the unique mortgage. Ultimately, you’ll solely have one observe on the house and can pocket the $60,000 (roughly, after closing prices and such).

Conversely, a HELOC entails taking a second mortgage out towards the fairness of your private home. This $60,000 (or no matter quantity) line of credit score could possibly be taken out along with your authentic lender or a brand new one; it doesn’t matter. Take into account, although, that should you spend towards that line of credit score, you’ll now have two month-to-month funds: one for the unique mortgage and one to repay the HELOC.

HELOCs sometimes have increased rates of interest in comparison with refinanced mortgages. Nevertheless, whereas a cash-out refinance is less complicated when it comes to solely managing one debt, a profit with the HELOC is that it doesn’t have closing prices.

Earlier than you determine to make use of your private home’s fairness as a supply of money, be sure you do the mathematics. You might find yourself costing your self extra in the long term (and shedding the safety of your private home’s built-up fairness) within the course of.

Mortgage Refinance Calculator

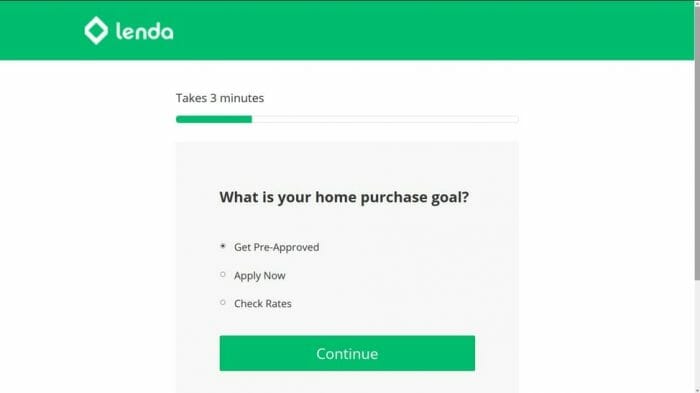

Fee choices

Will You Save Cash?

The most important query when contemplating a mortgage refi, for most individuals, is, “Will it save me cash?” Whereas the reply is totally different for everybody, there are a couple of key elements to contemplate when doing all your calculations.

Can You Do Higher?

First, decide whether or not or not you will get a decrease rate of interest. If that’s your cause for exploring a refi, it’s worthwhile to know if it’s the appropriate time.

Take a look at current developments in mortgage charges and the way a lot the present marketed charges differ out of your present fee. You’ll be able to even apply and see what you qualify for by means of a couple of totally different lenders. There are mortgage aggregator instruments obtainable (to view a number of lenders without delay), or you’ll be able to simply store round.

Rise up-to-date credit score experiences and scores (totally free!) to know the place you stand. If there are bank card balances which you could pay down or unfavourable experiences which might be about to fall off, it’s value holding off in your refi for a couple of months. That method, your credit score is in the most effective place it may be in earlier than you apply.

Additionally take into account that in case you have a number of lenders pull your credit score throughout the identical 14-day timeframe, it is going to solely depend towards your credit score report as soon as. This “fee purchasing” timeframe can go as excessive as 45 days with some FICO scoring fashions. However the older fashions (which some lenders nonetheless use) solely offer you 14 days. Because you by no means know which mannequin a possible lender will use, maintain that in thoughts.

Collect your assets and store away.

Breakeven level

To determine whether or not refinancing your mortgage is the neatest monetary transfer, you’ll have to know your breakeven level. Because the title suggests, that is the purpose at which you’ll break even between what a refi prices you and the way a lot it is going to prevent. Should you intend to promote your private home earlier than this level, refinancing is a waste of time and cash.

In an effort to decide your breakeven level, you’ll have to know your mortgage origination payment. Whereas this will likely differ from lender to lender, it’s sometimes round 1% of the mortgage complete. So, should you’re refinancing your private home for $200,000, you’ll be able to count on your mortgage origination payment to be roughly $2,000.

As soon as you realize that and have a common thought of what your new rate of interest can be, you should use a mortgage comparability calculator (like this one) to see when your financial savings shall be realized. It’s going to evaluate your authentic (present) mortgage mortgage with a brand new, refinanced mortgage to see if and once you’ll lower your expenses.

It’s going to present you your breakeven level, in addition to the purpose at which you’ll cease seeing financial savings (in case you have too lengthy of a refinance time period, for example). That method, you understand how lengthy it’s best to refinance your private home for, so you’ll be able to keep away from throwing cash away.

Deciding whether or not or not a mortgage refi is best for you is a private choice. It relies on your credit score rating, how a lot you owe, present fee developments, and your cause for refinancing.

Nevertheless, by doing a little bit little bit of homework–and a few math–you’ll be able to be certain that you make the neatest monetary choice for your loved ones and your private home.

,