Taking out a personal loan is a big financial decision, so it’s important to know exactly what you’re doing.

We’ve put together a list of things to consider before taking out a personal loan.

In This Article:

- Things To Do Before Applying for a Personal Loan

- The Best Loan Comparison Platform

- What to Look For in a Lender

- Different Types of Personal Loans

- Typical Loan Application Documents

- Frequently Asked Questions (FAQs)

- Final Thoughts

Things To Do Before Applying for a Personal Loan

There’s no shortage of things to know before taking out a personal loan. Rather than jump into the personal loan application process without giving it a second thought, here are nine steps to take.

1. Check Your Budget

Doing so gives you a better idea of if you can afford another monthly loan payment. This is step number one, so don’t do anything until you complete it.

2. Check Your Credit Report

Your goal is to obtain a high-level overview of your debts, while also learning more about your credit score.

3. Contact a Financial Advisor

A financial advisor can answer your questions, provide guidance, and help you decide for or against a personal loan.

4. Work Out Your Monthly Debt Payments

You must stay on track with your personal loan repayments. A big part of this is knowing your current monthly debt payments.

5. Make a Note of Your Total Income

Do you earn enough money to take on a personal loan? Does your income fluctuate?

6. Make a Note of your Assets and Liabilities

Write down both your assets and liabilities. Review them carefully to determine if there’s any reason to forgo a personal loan at this point.

7. Organize Your Documents

When completing a personal loan application, you’re likely to be asked for things such as a pay stub, bank statements, and proof of employment.

8. Work Out What You Can Afford Before Applying

Just the same as any other type of loan, you should know what you can afford to add to your budget before completing an application.

9. Shop Around Carefully

Don’t assume that one personal loan lender is the same as the next. With a detailed approach to personal loan shopping, you’ll gain a better understanding of what’s available and what’s best for you.

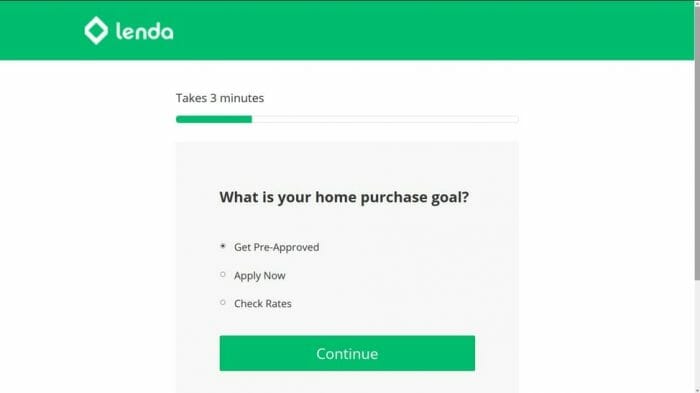

The Best Loan Comparison Platform

A sound personal loan comparison will go a long way in helping you make an informed and confident decision.

Monevo is the best personal loan comparison tool, as it gives you the opportunity to shop multiple lenders within a matter of minutes.

Also, you can use Monevo to filter your results, such as by credit score and the amount of money you want to borrow.

If you want to find the best loan for your personal finances, Monevo is a tool that you need by your side.

What to Look For in a Lender

Personal loan shopping is all about finding a lender that suits you and your financial circumstances. Here are some of the things you should look for.

Experience and Credibility

The best lenders have many years of experience combined with a reputation for doing things the right way.

Interest Rates

You want your personal loan interest rate to be as low as possible. The lower the rate, the lower your monthly payment. Focus on this detail as you compare lenders.

Repayment Flexibility

What repayment periods are available? Is the lender flexible enough to meet your needs? Your monthly payment is based largely on the term you choose.

Response Times

The personal loan application process isn’t confusing. Once you submit your application, you should expect to receive a decision within 24 to 48 hours, at the most.

Customer Service

The personal loan provider you choose should be dedicated to providing a high-level customer service experience. This will put your mind at ease.

Different Types of Personal Loans

In an overall sense, there are two types of personal loans:

- Unsecured loan: An unsecured loan is one that does not require collateral. The lender takes on more risk with this type of loan.

- Secured loan: A secured loan requires collateral.

Most personal loans are unsecured, but you may find a lender that offers a secured option as a means of getting a lower interest rate.

Typical Loan Application Documents

The personal loan application process is full of documentation. Fortunately, when you obtain the right documents early on, it’ll save you time in the future. Here’s what you should have ready:

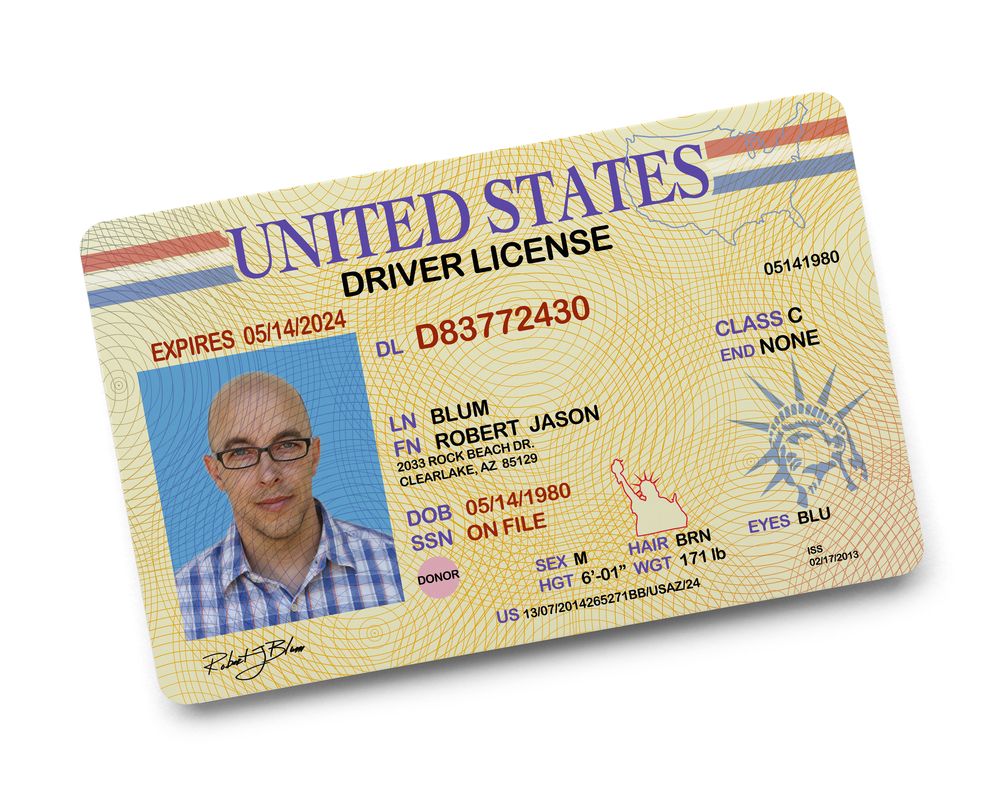

Proof of Identity

A driver’s license may be all you need, but your lender could require two types of proof.

Employer and Income Verification

A pay stub is generally good enough, but your personal loan lender may want to contact your employer to verify your status.

Proof of Address

The most common proof of address is a copy of a bank statement or utility bill.

Before you complete an application, ask your lender what type of documentation they need. This will allow you to collect it upfront, so you don’t get caught by surprise down the road.

Frequently Asked Questions (FAQs)

With so many things to consider before taking out a personal loan, it’s easy to become overwhelmed. However, you can fight against this by answering any and every question that’s on your mind.

Here are some of the most frequently asked questions as they pertain to personal loans.

What is a good credit score?

According to Experian, a good credit score falls in the range of 700 to 850. The higher your credit score the easier it is to get a personal loan.

How do personal loans work?

Once you apply for a personal loan and receive approval, you can then accept or deny the funds. Should you be interested in moving forward, your lender will wire the funds to your bank account. You are then free to use the money however you best see fit.

What is a secured loan?

A secured loan requires collateral. For example, a car loan is a secured loan as the vehicle acts as collateral. The lender can repossess it if you default on payments.

What is an unsecured loan?

An unsecured loan is a type of loan that does not require collateral. Since the lender is taking on more risk, the interest rate is typically higher. Most personal loans are unsecured loans.

Do personal loans impact your credit score?

Yes, a personal loan will impact your credit score. Your personal loan lender will report activity to the three major credit bureaus. As long as you pay in full and on time, your loan will have a positive impact on your score.

How much can I borrow for a personal loan?

This depends on a variety of factors, such as the lender you choose, your credit score, your income, and your debt load. Remember this: you don’t have to borrow as much money as you qualify for. Make your decision based on your needs and personal finances as a whole.

Do loan companies check your bank account?

Yes, loan companies check your bank account(s). They do so to verify your income and to show how much money comes into and goes out of your account. This holds true for all types of loans, from personal loans to mortgages.

Do personal loan lenders contact your employer?

This depends on your personal loan provider. Some will contact employers to verify employment. Others are okay with doing so via a recent pay stub.

Do you need to give a reason for a personal loan?

While your lender may ask why you want a personal loan, there’s no right or wrong answer. As long as you plan on using the money for legal reasons, you should be okay.

How much of a personal loan can you afford?

Answering this question starts with a review of your budget, income, and current loan repayments. From there, you can decide how much of a monthly loan payment you’re comfortable with.

Which repayment period is best for you?

Personal loan terms vary. Most lenders offer loans ranging from 12 to 96 months, however, this can and will vary. The longer your term, the lower your payment. However, a longer term also means that your personal loan interest rate will have a bigger impact.

Do you know exactly how you want to use the funds from a personal loan?

If you qualify for a personal loan, it sounds like a no-brainer to accept the funds. But before you do this, clearly define how you’ll use the money.

Final Thoughts

These are the types of things to know before taking out a personal loan. No matter how much money you want to borrow or which lender you want to use, be sure that you have a full understanding of your personal financial circumstances.

With the right knowledge, it’s easier to decide for or against a personal loan. Should you realize that now’s the time to apply, compare lenders with the idea of finding the one that best matches your wants, needs, and budget.

,